List of Brokers for Oil Trading

Energy commodities are considered to be very important parts of any industrialized economy. As a result, the prices of these commodities also tend to follow economic growth in the world. One of those kinds is oil, energy commodity which commonly used for heating, transportation, cooking, and so on. The market for oil is by far the biggest.

This page will give you a list of Forex Brokers that offer oil as its trading instrument.

Scroll for more details

Why only offline forex trading is regulated in Nigeria?

Offline forex trading in Nigeria, particularly in the crude oil sector, is well-regulated due to the significant role of crude oil in the country's economy and international transactions. This sector involves various parties, including commercial banks, legal buyers and sellers, oil companies, and the Central Bank of Nigeria, which supervises the industry.

Continue Reading at Is It Safe to Trade Forex in Nigeria?

What is shale fracking in oil exploration?

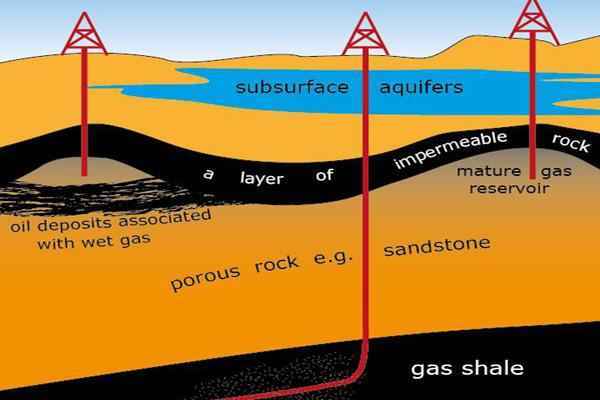

Hydraulic Fracturing, also known by its shorter nickname Fracking is a method to drill well by injecting high-pressure fluids in order to create fractures in deep-rock formation where gas and petroleum could flow through much more easily. Such a method has been in practice for a long time. In the US particularly, it has been done since 1949.

Continue Reading at How World Oil Prices Affect Forex, Before And After US Shale Fracking

Where does Brent Crude Oil come from?

Brent Crude serves as the benchmark for crude oil in European, African, and Middle Eastern markets. It is a blend of four different crude oils, specifically Brent, Forties, Oseberg, and Ekofisk, collectively known as BFOE quotations.

Continue Reading at Why Are WTI and Brent Prices Different?

How does oil price correlate to the currency market?

- The global crude oil price is pegged in US Dollars, so fluctuations in the value of the US Dollar will directly affect the global oil price.

- The forex pair that is most correlated with world crude oil prices is USD/CAD. If the price of crude oil rises, the CAD will rise and vice versa.

Continue Reading at All You Need to Know About Intermarket Analysis

Instruments Traded

Broker Categories

Minimun Deposit

Payment

License

Country

Established

Features

Trading Platform